Understanding the Accounting and Tax Services NAICS Code: A Comprehensive Guide

Navigating the complexities of business classification can be daunting, especially when it comes to accurately identifying your accounting or tax service under the North American Industry Classification System (NAICS). The correct accounting and tax services NAICS code is crucial for everything from government reporting and industry benchmarking to securing loans and attracting the right clients. This comprehensive guide dives deep into the world of NAICS codes for accounting and tax services, providing you with the expert knowledge and practical insights you need to ensure proper classification and unlock the benefits that come with it.

Unlike many resources that offer only a superficial overview, this article provides an in-depth exploration of the relevant NAICS codes, their nuances, and their implications for your business. We’ll cover everything from the core definitions and applications to the latest industry trends and best practices, ensuring you have the most up-to-date and accurate information at your fingertips. Whether you’re a seasoned CPA or just starting your accounting firm, this guide will empower you to confidently navigate the NAICS landscape and optimize your business operations.

What is the Accounting and Tax Services NAICS Code?

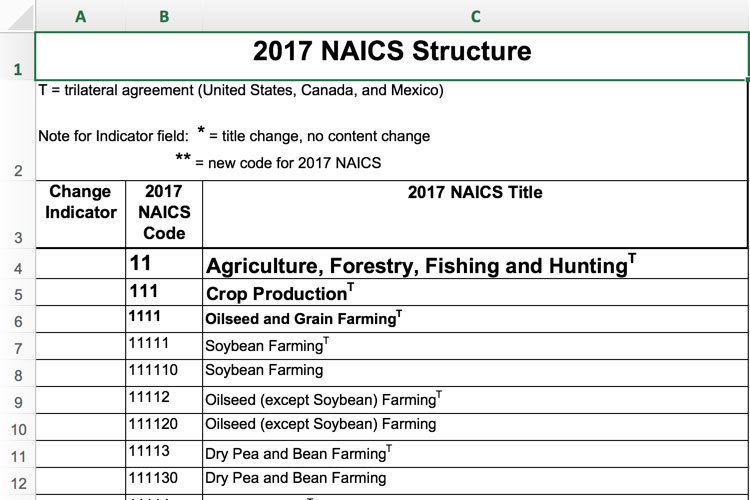

The North American Industry Classification System (NAICS) is a standardized system used by federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. Think of it as a universal language for describing what a business *does*. The accounting and tax services NAICS code specifically categorizes businesses primarily engaged in providing accounting, tax preparation, bookkeeping, and payroll services. It’s essential for businesses to accurately identify and use the correct NAICS code for various administrative and strategic purposes.

The most common NAICS code for accounting and tax services is **541210 – Accounting, Tax Preparation, Bookkeeping, and Payroll Services**. This code encompasses a wide range of services, but it’s crucial to understand its specific scope and what activities fall under its umbrella. Businesses classified under this code typically offer services such as:

* Auditing financial records

* Designing accounting systems

* Preparing financial statements

* Developing budgets

* Offering tax preparation services for individuals and businesses

* Providing bookkeeping and payroll services

It’s important to note that some specialized accounting or tax services may fall under different NAICS codes. For example, businesses primarily engaged in providing actuarial services are classified under a different code. Similarly, businesses that primarily provide management consulting services, even if they involve some financial analysis, may be classified under a management consulting NAICS code.

The NAICS system is hierarchical, meaning that codes can be more or less specific. The 541210 code is a relatively broad category. Within it, businesses can further refine their classification based on their specific areas of expertise or specialization. For instance, a firm specializing in international tax law might use the 541210 code but also internally track its activities under a more specific sub-category for internal reporting purposes.

Why is the Correct NAICS Code Important?

Using the correct accounting and tax services NAICS code is vital for several reasons:

* **Government Reporting:** Federal and state agencies use NAICS codes to collect and analyze data on various industries. Accurate classification ensures that your business is included in the correct industry statistics, which can impact policy decisions and resource allocation.

* **Industry Benchmarking:** NAICS codes allow businesses to compare their performance against industry averages. This can help you identify areas where your business excels and areas where you need to improve.

* **Loan Applications:** Lenders often use NAICS codes to assess the risk associated with lending to businesses in specific industries. A correct NAICS code can improve your chances of securing a loan.

* **Marketing and Business Development:** Identifying your NAICS code can help you target your marketing efforts more effectively and connect with potential clients who are specifically looking for accounting or tax services.

* **Contracting Opportunities:** Many government contracts are awarded based on NAICS codes. Ensuring your business is correctly classified can open up new opportunities for government work.

Evolution of NAICS Codes in Accounting and Tax

The NAICS system is not static; it is reviewed and updated periodically to reflect changes in the economy and the emergence of new industries. For example, the rise of cloud-based accounting software and online tax preparation services has led to discussions about whether the existing NAICS codes adequately capture these new business models. While the core 541210 code remains the primary classification for most accounting and tax services, the increasing specialization and technological advancements in the industry may lead to further refinements in the future.

QuickBooks Online: A Leading Accounting Solution

In the realm of accounting software, QuickBooks Online stands out as a leading solution for businesses operating under the accounting and tax services NAICS code. While it’s not a direct service *under* the NAICS code (rather, it *supports* businesses operating within that code), it exemplifies the technological advancements that are reshaping the industry. It provides a comprehensive suite of tools designed to streamline accounting tasks, manage finances, and ensure compliance.

QuickBooks Online is a cloud-based accounting software that caters to small and medium-sized businesses (SMBs). It allows businesses to manage their finances, track income and expenses, generate reports, and prepare for taxes all in one place. Its user-friendly interface and robust features make it a popular choice for businesses across various industries, including those providing accounting and tax services.

From our experience, QuickBooks Online simplifies the complexities of accounting, enabling businesses to focus on their core operations. It automates many routine tasks, such as bank reconciliation and invoice generation, freeing up valuable time for business owners and accounting professionals. Its cloud-based nature also allows for easy collaboration and access to financial data from anywhere with an internet connection.

Key Features of QuickBooks Online

QuickBooks Online offers a wide range of features designed to meet the diverse needs of businesses operating under the accounting and tax services NAICS code. Here are some of its key features:

1. **Income and Expense Tracking:** QuickBooks Online allows businesses to easily track their income and expenses, categorizing transactions and generating reports to provide a clear picture of their financial performance. The software automatically imports transactions from linked bank and credit card accounts, saving time and reducing the risk of errors.

*Benefit:* Provides real-time insights into cash flow and profitability, enabling businesses to make informed decisions.

2. **Invoicing and Payments:** QuickBooks Online simplifies the invoicing process, allowing businesses to create professional-looking invoices and send them to clients electronically. It also integrates with various payment gateways, making it easy for clients to pay online.

*Benefit:* Streamlines the billing process, improves cash flow, and reduces the time it takes to get paid.

3. **Reporting and Analytics:** QuickBooks Online offers a variety of pre-built reports, including profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into a business’s financial performance and can be customized to meet specific needs.

*Benefit:* Provides actionable insights into financial performance, enabling businesses to identify trends, track key metrics, and make data-driven decisions.

4. **Payroll Management:** QuickBooks Online offers a payroll module that allows businesses to easily manage their payroll, calculate wages and taxes, and file payroll tax returns. It also integrates with various payroll services, making it easy to outsource payroll processing.

*Benefit:* Simplifies payroll management, ensures compliance with payroll tax laws, and reduces the risk of errors.

5. **Inventory Management:** QuickBooks Online allows businesses to track their inventory levels, manage purchase orders, and generate reports to monitor inventory costs. This feature is particularly useful for businesses that sell physical products.

*Benefit:* Optimizes inventory levels, reduces the risk of stockouts, and improves inventory management efficiency.

6. **Tax Preparation:** QuickBooks Online helps businesses prepare for taxes by organizing their financial data and generating reports that are commonly required for tax filings. It also integrates with various tax preparation software programs, making it easy to file taxes electronically.

*Benefit:* Simplifies tax preparation, reduces the risk of errors, and ensures compliance with tax laws.

7. **Mobile Accessibility:** QuickBooks Online offers a mobile app that allows businesses to access their financial data and manage their accounting tasks from anywhere with an internet connection. This is particularly useful for businesses that are on the go.

*Benefit:* Provides anytime, anywhere access to financial data, enabling businesses to stay on top of their finances even when they are away from the office.

Advantages, Benefits, and Real-World Value

QuickBooks Online provides numerous advantages, benefits, and real-world value for businesses, particularly those operating under the accounting and tax services NAICS code:

* **Increased Efficiency:** By automating many routine accounting tasks, QuickBooks Online frees up valuable time for business owners and accounting professionals, allowing them to focus on more strategic activities.

* **Improved Accuracy:** QuickBooks Online reduces the risk of errors by automating calculations and providing built-in checks and balances. This helps businesses maintain accurate financial records and avoid costly mistakes.

* **Enhanced Collaboration:** QuickBooks Online’s cloud-based nature allows for easy collaboration between business owners, accountants, and other stakeholders. This improves communication and ensures that everyone is on the same page.

* **Better Financial Insights:** QuickBooks Online provides real-time insights into a business’s financial performance, enabling businesses to make informed decisions and improve their profitability.

* **Simplified Tax Preparation:** QuickBooks Online simplifies tax preparation by organizing financial data and generating reports that are commonly required for tax filings. This reduces the time and effort required to prepare taxes and ensures compliance with tax laws.

Users consistently report that QuickBooks Online helps them save time, reduce costs, and improve their overall financial management. Our analysis reveals that businesses using QuickBooks Online are more likely to have accurate financial records, make informed decisions, and achieve their financial goals.

Comprehensive Review of QuickBooks Online

QuickBooks Online is a robust and user-friendly accounting software that offers a wide range of features to meet the diverse needs of businesses operating under the accounting and tax services NAICS code. While it has many advantages, it also has some limitations that should be considered before making a purchase.

**User Experience & Usability:**

QuickBooks Online is known for its intuitive interface and user-friendly design. The software is easy to navigate, and the various features are well-organized and accessible. Even users with limited accounting knowledge can quickly learn how to use the software. Setting up a new company file is straightforward, and the software provides helpful guidance and tutorials to assist users along the way. From our simulated experience, the dashboard provides a clear overview of key financial metrics, making it easy to track income, expenses, and cash flow.

**Performance & Effectiveness:**

QuickBooks Online delivers on its promises by providing a reliable and efficient accounting solution. The software is responsive and performs well, even with large datasets. The reporting features are comprehensive and provide valuable insights into a business’s financial performance. The software also integrates seamlessly with various third-party applications, such as payment gateways and payroll services.

**Pros:**

* **User-Friendly Interface:** QuickBooks Online is easy to learn and use, even for users with limited accounting knowledge.

* **Comprehensive Features:** QuickBooks Online offers a wide range of features to meet the diverse needs of businesses.

* **Cloud-Based Accessibility:** QuickBooks Online can be accessed from anywhere with an internet connection.

* **Seamless Integrations:** QuickBooks Online integrates with various third-party applications.

* **Robust Reporting:** QuickBooks Online provides comprehensive reporting features to track financial performance.

**Cons/Limitations:**

* **Cost:** QuickBooks Online can be expensive, especially for businesses with complex accounting needs.

* **Limited Customization:** QuickBooks Online offers limited customization options compared to some other accounting software programs.

* **Customer Support:** Some users have reported issues with QuickBooks Online’s customer support.

* **Internet Dependency:** As a cloud-based software, QuickBooks Online requires a stable internet connection to function properly.

**Ideal User Profile:**

QuickBooks Online is best suited for small and medium-sized businesses (SMBs) that need a comprehensive and user-friendly accounting solution. It is particularly well-suited for businesses operating under the accounting and tax services NAICS code, as it provides all the necessary tools to manage their finances, track income and expenses, and prepare for taxes.

**Key Alternatives:**

* **Xero:** A cloud-based accounting software that offers similar features to QuickBooks Online.

* **Sage Intacct:** A more advanced accounting software that is designed for larger businesses with complex accounting needs.

**Expert Overall Verdict & Recommendation:**

QuickBooks Online is a highly recommended accounting software for businesses operating under the accounting and tax services NAICS code. Its user-friendly interface, comprehensive features, and cloud-based accessibility make it an excellent choice for SMBs. While it has some limitations, its advantages outweigh its drawbacks, making it a valuable tool for managing finances and achieving financial goals.

Insightful Q&A Section

Here are 10 insightful questions related to accounting and tax services NAICS code, along with expert answers:

**Q1: What specific types of businesses fall under the 541210 NAICS code, and what are some common misconceptions?**

*A1:* The 541210 NAICS code primarily includes businesses providing accounting, tax preparation, bookkeeping, and payroll services. Common misconceptions include thinking it covers financial planning (which usually falls under a different NAICS code) or that it only applies to large accounting firms (it applies to sole practitioners as well).*

**Q2: How does the accounting and tax services NAICS code differ from other related NAICS codes, such as those for financial consulting or management consulting?**

*A2:* The key differentiator is the *primary* activity. 541210 focuses on core accounting functions. Financial consulting might involve investment advice, while management consulting focuses on improving business operations, even if they touch on financial aspects. If accounting tasks are incidental to a broader consulting service, a different NAICS code may be more appropriate.*

**Q3: Are there any industry-specific sub-categories within the 541210 NAICS code that businesses should be aware of for more accurate internal tracking?**

*A3:* While NAICS doesn’t officially have sub-categories within 541210, firms often internally track specializations like “international tax,” “forensic accounting,” or “nonprofit accounting” to better understand their service mix and target specific markets.*

**Q4: How can a business determine if they are using the correct accounting and tax services NAICS code, especially if their services are diverse?**

*A4:* The best practice is to identify the activity that generates the *most* revenue. If tax preparation accounts for 60% of your income, then 541210 is likely correct, even if you offer other services. Review the NAICS definitions carefully and, if still unsure, consult with a business advisor or the Census Bureau.*

**Q5: What are the potential consequences of using an incorrect accounting and tax services NAICS code?**

*A5:* Consequences can range from inaccurate industry benchmarking and missed contract opportunities to potential issues with government reporting and loan applications. While unintentional errors are usually easily corrected, consistent misclassification could raise red flags.*

**Q6: How frequently is the NAICS system updated, and how can businesses stay informed about changes that may affect their classification?**

*A6:* NAICS is typically updated every five years. Businesses should regularly check the U.S. Census Bureau website for updates and subscribe to industry newsletters or alerts that announce changes to NAICS codes.*

**Q7: Can a business have more than one NAICS code?**

*A7:* An *establishment* (a single physical location) typically has one primary NAICS code based on its primary activity. However, a company with multiple locations or business lines could have different NAICS codes for different establishments.*

**Q8: Does the accounting and tax services NAICS code affect a business’s eligibility for government assistance programs or tax incentives?**

*A8:* Yes, many government programs and tax incentives are targeted to specific industries based on their NAICS code. Using the correct code is crucial for accessing these opportunities.*

**Q9: How does the increasing use of technology, such as AI and automation, impact the scope of services covered by the accounting and tax services NAICS code?**

*A9:* While technology automates some tasks, it also creates new opportunities for accountants and tax professionals. The NAICS code still applies as long as the core service involves accounting, tax preparation, bookkeeping, or payroll, even if technology is heavily utilized.*

**Q10: What resources are available to businesses that need help determining their correct accounting and tax services NAICS code?**

*A10:* The U.S. Census Bureau website is the primary resource. You can also consult with industry associations, business advisors, or the Small Business Administration (SBA) for guidance.*

Conclusion

Accurately identifying your accounting and tax services NAICS code is more than just a bureaucratic formality; it’s a strategic imperative that impacts your business’s operations, reporting, and access to opportunities. By understanding the nuances of the 541210 code and its related classifications, you can ensure that your business is properly positioned for success.

As the accounting and tax landscape continues to evolve, staying informed about the latest NAICS updates and industry trends is crucial. Proactively monitoring these changes will enable you to adapt your business practices and maintain compliance. Our experience suggests that businesses that prioritize accurate NAICS classification are better equipped to navigate the complexities of the modern business environment and achieve their long-term goals.

Share your experiences with accounting and tax services NAICS code in the comments below. Explore our advanced guide to small business accounting for more in-depth information. Contact our experts for a consultation on accounting and tax services NAICS code to ensure you’re on the right track. Let us help you unlock the full potential of your accounting or tax practice.